Definitive Feasibility Study

Alliance Nickel completed the Definitive Feasibility Study (DFS) for its 100% owned NiWest Nickel-Cobalt Project in November 2024, confirming the Project as a commercially attractive development opportunity with strong ESG credentials and significant upside (refer to ASX Announcement released 21 November 2024).

DFS HIGHLIGHTS

35 years

LIFE OF MINE (LOM)

US$4.84/lb Ni

FIRST QUARTILE ALL-IN SUSTAINING COST (AISC) OF us$4.84/LB NICKEL (FIRST 12 YEARS)

A$6.1 billion

LOM POST-TAX FREE CASHFLOW

84.7MT

@0.94% NI AND 0.06% CO I JORC COMPLIANT ORE RESERVE

20kt Ni & 1.6kt Co

AVERAGE ANNUAL PRODUCTION, FIRST 12 YEARS

A$1.5 billion

POST-TAX NET PRESENT VALUE (NPV)

The DFS confirms that NiWest represents a commercially attractive development opportunity with strong ESG credentials and significant upside.

- NiWest contains one of the highest-grade undeveloped nickel laterite resources in Australia

- Once operational, the Project will become a sustainable and ethical producer of premium end, high purity, IRA compliant nickel and cobalt sulphate – both direct-ship precursor products for battery cathode manufacturers and critical minerals supply chain

- 35-year LOM, processing higher grade ore for the first 27 years of operation followed by an 8-year period of processing remaining previously mined and stockpiled low-grade ore

- Average production capacity of 90,000 tpa nickel sulphate (20,000 tpa contained nickel) and 7,700 tpa cobalt sulphate (1,600 tpa contained cobalt) for the first 12 years of operation

- Open pit mining operation utilising low-cost heap leaching process

- Long-term average LME nickel price forecast of US$20,216/t plus a premium for nickel sulphate product, and cobalt price forecast of US$32,556/t

- Major Project Status awarded by the Australian Federal Government recognises NiWest’s significant economic potential, which includes the creation of 900 jobs during construction and operation

- Alliance is well positioned to capitalise on the transition in electric vehicle and battery storage markets

- The DFS is a culmination of two years’ work by Alliance in collaboration with global engineering company Ausenco and other leading consultants

economic advantage

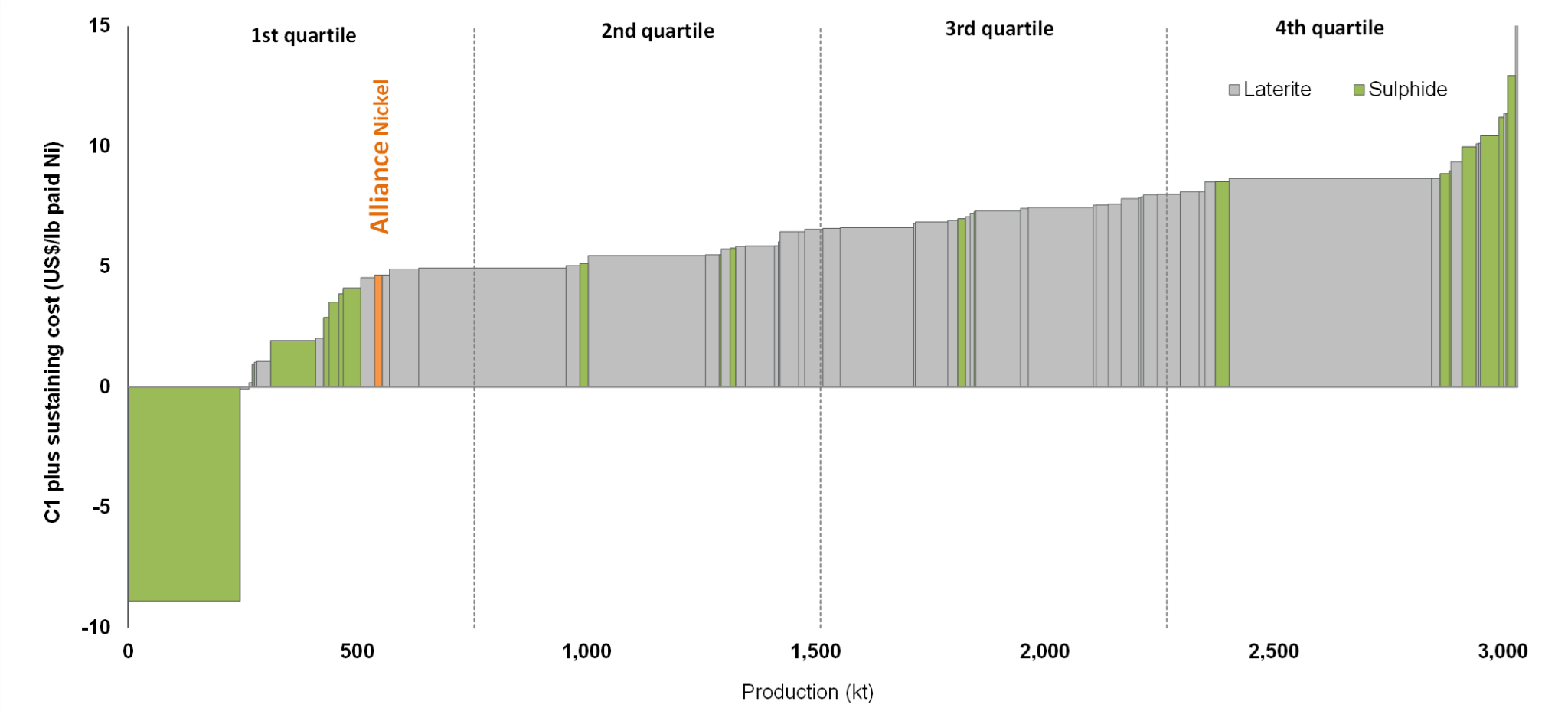

- First quartile AISC (inc. cobalt credits), US$4.84/lb for the first 12 years of operations and US4.95/lb for 27 years of high-grade operations.

- The NiWest Project AISC cost is firmly within the first cost quartile compared to domestic and international nickel producers.

- The operations with costs below that of those projected for Alliance are predominately polymetallic producers with significant by-product credits arising from copper and platinum group metals production.

- Norilsk in particular produces over 300kt of copper and 120t of platinum group metals together with 220kt of nickel (source: Wood Mackenzie commentary).

Figure. C1 plus sustaining costs (US$/lb) paid nickel net of by product credit 2024 real terms

Source: Alliance Nickel’s DFS / Wood Mackenzie