COMPANY OVERVIEW

Alliance Nickel is an ASX-listed exploration and development company with nickel and cobalt interests in Western Australia.

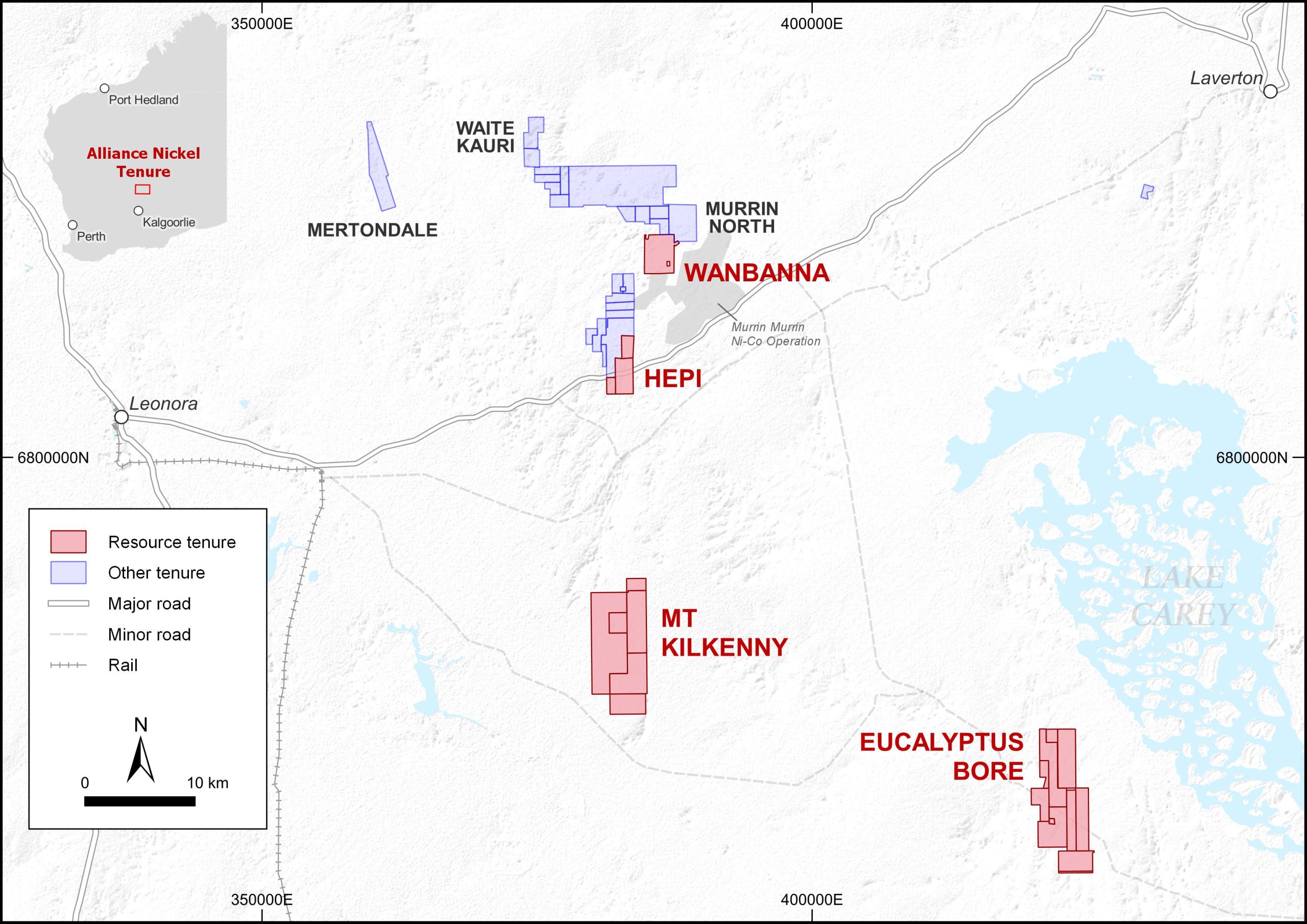

Our principal asset is our 100% owned NiWest Nickel Cobalt Project situated adjacent to Glencore’s Murrin Murrin Operations in the North Eastern Goldfields of Western Australia. The Murrin Murrin area is globally recognised as an established nickel and cobalt producing region.

NiWest hosts one of the highest-grade undeveloped nickel laterite Mineral Resources in Australia estimated to contain 85.2 million tonnes averaging 1.03% nickel and 0.06% cobalt. Over 75% of the resource is contained within the Measured and Indicated JORC categories with potential to expand the currently delineated mineralisation with further drilling.

The project is in close proximity to critical open access infrastructure such as rail and gas lines, arterial roads and the mining township of Leonora. Water resources have been established and a 2GL extraction license has been granted. We have completed extensive metallurgical test work focused on Heap Leaching technology. A successful commercial heap leach on similar ore has been trialled at Glencore’s adjacent Murrin Murrin Nickel-Cobalt Refinery.

Updated PFS outcomes for NiWest

An extensive PFS was completed on NiWest and released in mid-2018, including declaration of a maiden Ore Reserve. This study demonstrated the technical and economic robustness of a longlife operation directly producing high-purity nickel and cobalt sulphate products to be delivered into highgrowth lithium-ion battery raw material markets.

In the June Quarter 2022, we undertook an update of the cost and A$/US$ metal price assumptions utilised in the PFS 2018. All physical parameters from the PFS 2018 remained unchanged as part of this exercise, including the mine and process schedule and the Ore Reserve.

The update confirmed the robustness of a long-life operation directly producing high-purity nickel and cobalt sulphate products to be delivered into lithium-ion battery raw material markets. The update incorporated higher nickel and cobalt prices and cost escalation impacts since PFS 2018 including LME spot prices of approx. US$9.80/lb nickel and US$27/lb cobalt.

Mine and process schedule, along with all PFS physical parameters (incl. Ore Reserve), were unchanged and focus upon:

- Low-strip open pit mining and heap leaching followed by highly efficient Direct Solvent Extraction (DSX) to produce low-cost battery grade nickel and cobalt sulphate products. Initial 27-year operating life at a nameplate processing capacity of 2.4Mtpa.

- Total production of 456kt nickel (in nickel sulphate) and 31.4kt cobalt (in cobalt sulphate). Average annual production of c.20kt nickel and 1.4kt cobalt over the first 15 years.

The update delivers substantial increases to projected economic returns from development of NiWest.

Commencement of DFS

The Updated PFS outcomes have resulted in Alliance Nickel's Board seeking to proceed to a Definitive Feasibility Study (DFS) on NiWest.

Activities have commenced on the DFS which will incorporate a number of value engineering opportunities identified in the original PFS that have the potential to improve the NiWest Project economics significantly.

We continue to engage with potential strategic partners, offtake parties and technology developers that can assist in unlocking the value of the NiWest Project.